what is tax lot meaning

Tax Lot Accounting Definition is an example of a term used in the field of economics Personal Finance - Taxes. Tax Lot means a parcel lot or other unit of land as created by the county assessor for the purpose of taxation.

Property Tax In The United States Wikipedia

What Are Tax Lots.

. What is tax lot meaning Tuesday March 15 2022 Edit. What does TAX LOT mean. The tax lot will detail the terms of each transaction that involves each security in the.

Updated September 29 2020 What is Tax Lot Accounting. Tax lot accounting is a method of record keeping that tracks the cost purchase date and sale date for every. Tax lot Noun A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting.

Tax-lot definition Meanings accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. Tax lot noun A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting. Each acquisition of a security on a different date or for a different price constitutes a new tax lot.

Tax lots are records of data pertaining to your acquisition of securities like stock bonds and options. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares. When shares of the same security are purchased the new positions create additional tax lots.

Every time you buy shares an Open Tax Lot is created to track the date and the price of the purchased security. Shares purchased in a single transaction are referred to as a lot for tax purposes. Tax Lot Accounting A method of accounting for a portfolio in which one keeps a record of the purchase price and sale price of each security in the portfolio along with each ones cost basis.

A tax lot is a record of the details of an acquisition of a security. Tax lot Noun A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting. A tax lot is a record of all transactions and their tax implications dates of purchase and sale cost basis sale price involving a particular security in a portfolio.

These lots record data important to the. Tax lot accounting is a record-keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make. Tax lots are documents that relate to any and all transactions that have to do with the investment portfolio.

The Termbase team is compiling practical examples in using Tax Lot. What does tax lot mean. Each acquisition of a security on a different date or for a different price constitutes a new tax lot.

Tax lot noun An parcel of. A tax lot may also be a lot or parcel when created at a property owners. When you sell the shares tax lots allow us to automatically find the.

The tax lots are. What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Payment Tax Integrity. A tax lot is a record of the details of an acquisition of a security.

What Biden S Capital Gains Tax Proposal Could Mean For Your Wallet Fox Business

What Are Tax Lots And How Do They Affect Your Capital Gains

Tmbl Definition Tax Map Block And Lot Abbreviation Finder

Lab 1 Basic Lab Assignment Lab 1 Sayantan Das 2 1 Importing Data Studocu

Editorial Ready To Have Your Taxes Increased William D Truax Tax Advisors

Does Your State Have An Estate Or Inheritance Tax

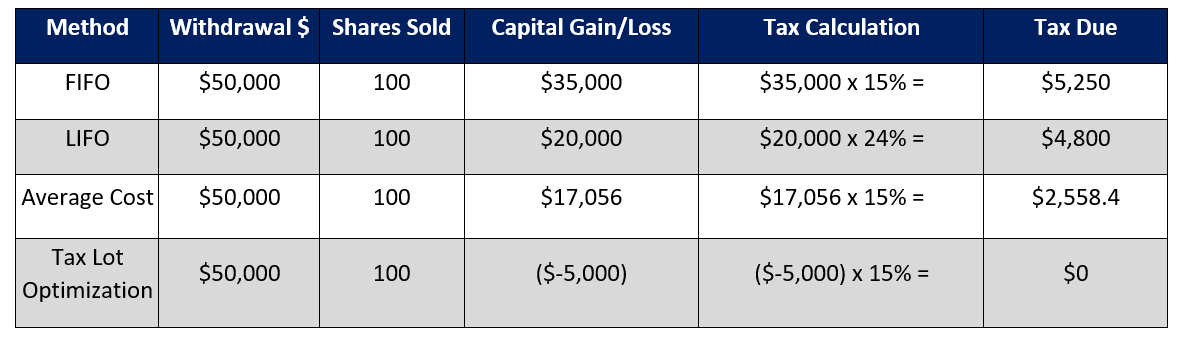

Tax Lot Optimization Why It Matters To Investors Level Financial Advisors

Tax Lot Optimization Why It Matters To Investors Level Financial Advisors

Save On Taxes Know Your Cost Basis Charles Schwab

Par21 0002 601 S Blaine Street Partition Newberg Oregon

What Does It Mean To Extend Your Tax Return Lance Cpa Group

Reasons To Aggressively Fight A Sales Tax Audit Strg

Sales Tax Discount Mental Percents Mean Decimal Operations

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Understanding Your Tax Forms The W 2

7 Tax Free Investments To Consider For Your Portfolio Smartasset